- Business Unfair Advantage

- Posts

- Into The Lender's Mind #7 Never run out of cashflow again

Into The Lender's Mind #7 Never run out of cashflow again

Follow these principles strictly, make them your business acumen and stay firm.

A business is a pure strategy game.

How to Never Run Out of Cashflow. It’s a game of give and take.

Cash flow is the lifeblood of any business. You can be profitable on paper, but if cash isn’t moving through your business at the right time, everything grinds to a halt. Wages get delayed. Suppliers chase you. Growth plans stall.

It’s a strategy game.

It’s a common trap. Business owners focus heavily on sales and profit, but forget that timing is just as important. Money tied up in unpaid invoices or delayed projects doesn’t pay the bills. That’s why smart business leaders treat cash flow management as a daily discipline, not an afterthought.

The good news is, you don’t need to be a finance expert to get this right. With a few simple systems and habits, you can build a business that never runs out of cash, one that has the flexibility to take opportunities, weather tough months, and grow on your terms.

Here are some practical steps you can put in place to make sure your cash keeps flowing, consistently and predictable. Instead of slashing prices to move stock, focus on raising the average order value.

1. Take Cash Upfront Wherever Possible

Don’t let your customers treat you like their bank.

Ask for deposits before starting work.

Use staged payments for bigger projects.

Consider offering a small discount for upfront payment if your margins allow.

Upfront cash is instant working capital. It shifts risk away from you and onto the customer, where it belongs.

2. Charge on a Percentage Basis

If the project runs over time, so does your cost. Fixing a flat fee without milestones is a recipe for cash crunch.

Tie payments to progress (e.g., 30% upfront, 40% mid-way, 30% on completion).

For ongoing services, bill monthly or even weekly rather than waiting until the end.

Think of it as cash flow insurance, protecting you against long waits and scope creep.

3. Move With Urgency

Cash flow delays happen when delivery drags. The longer you take, the longer you wait to be paid.

Provide services as quickly as possible.

Avoid downtime between jobs or contracts.

Automate admin tasks that slow invoicing.

The faster you deliver, the faster you invoice, the faster you collect.

4. Secure a Credit Line Before You Need It

Waiting until you’re gasping for cash is too late.

Arrange an overdraft or invoice finance facility.

Keep it as a safety net, not a last resort.

Lenders look far more favourably on businesses applying when things are steady rather than in crisis.

Think of it like an umbrella, you want it before it rains.

I met with a client this week to discuss his exit strategy. He owns a laundromat business in the U.S. that generates $20M in revenue with a 20% profit margin.

What’s remarkable is his journey: he bought the business 15 years ago for just $10,000 and scaled it to this level.

But the part that was really impressive for me was his approach to borrowing. He told me he’s taken bank loans three times over the years and was never out of desperation or to cover weak cash flow. Every time when the business was at its strongest he show a good opportunity to borrow money and scale.

5. Build Recurring Revenue

Ask yourself: Can I turn a one-off sale into a subscription?

Maintenance contracts instead of ad-hoc repairs.

Training packages instead of one-off sessions.

Monthly retainers instead of single projects.

Recurring revenue creates predictable cash flow and makes lenders much more comfortable funding your growth.

Here are some ways service businesses can turn one-off projects into steady income:

Maintenance or Support Contracts

IT firms → monthly support & monitoring instead of one-off fixes.

Marketing agencies → monthly retainers for strategy + reporting.

Accountants → monthly bookkeeping subscriptions instead of just year-end accounts.

Memberships & Subscriptions

Consultants → access to group coaching, templates, or resources for a flat monthly fee.

Fitness instructors → online classes or recorded content in a members-only platform.

Cleaning services → weekly/monthly recurring bookings with automatic billing.

Service Bundles

Legal advisors → package ongoing document reviews, compliance checks, and advice into a subscription.

HR consultants → monthly fee for recruitment support, training, and policy updates.

Web designers → monthly site maintenance, updates, and hosting.

“Productizing” Services

Turn knowledge into digital products: courses, cheat sheets, or templates.

Offer access to these via a subscription or membership hub for ongoing revenue.

6. Tighten Up Collections

Many businesses don’t have a cash flow problem, they have a collections problem.

Send invoices the moment work is done.

Follow up consistently (late payers often pay those who shout loudest).

Consider offering small incentives for early payment or penalties for late ones.

Remember: profit on paper is meaningless until it’s money in the bank.

7. Monitor and Forecast

Cash flow is not “set and forget.”

Run a rolling cash flow forecast weekly.

Stress test: what happens if a big client pays late?

Spot gaps early so you can plug them with finance, new revenue, or cost control.

What you measure, you can manage.

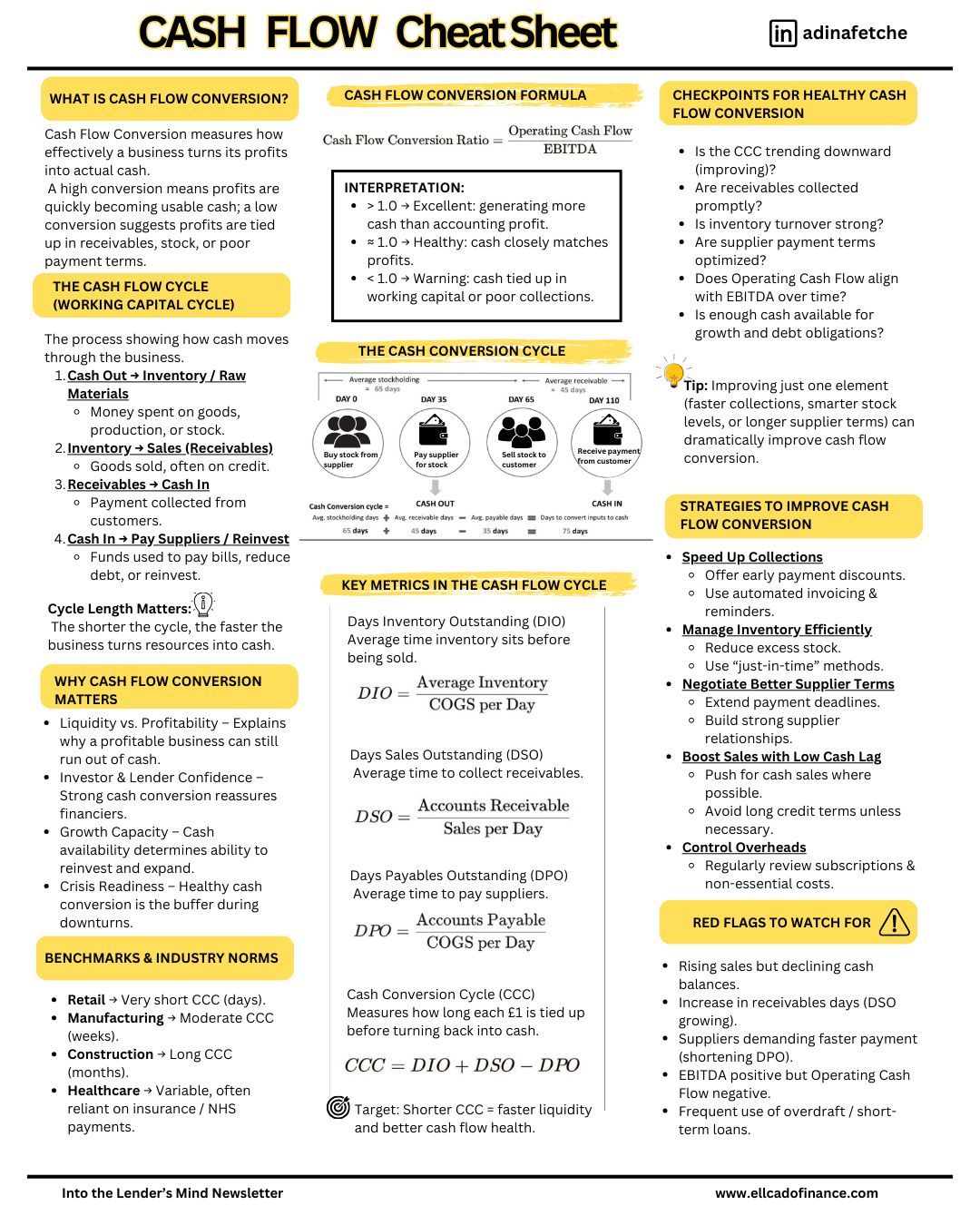

Bonus for Subscribers: Here’s my Cash Flow Cheat Sheet, a quick-reference guide to help you put these steps into practice. Keep it nearby as a reminder of the key levers that keep your cash moving.

|

8. Add Complementary Services (or Buy a Complementary Business)

Adding a complementary service, or even buying a business that fits naturally with what you already do, creates new revenue streams and makes your business more resilient.

💡 Subscriber Note:

Because many of you activate in sectors like consulting, healthcare, consumer services, and property, here are tailored examples of how this strategy could look in practice:

Consultant → Add online courses or digital templates alongside your 1:1 work.

Dental Practice → Introduce cosmetic services or launch a dental plan subscription.

Coffee Shop → Add bakery items, coworking space, or branded merchandise.

Gym/Fitness Studio → Offer nutrition coaching, supplements, or physiotherapy.

Pet Shop → Expand into grooming, training classes, or pet insurance partnerships.

Packaging Company → Provide design services or warehousing solutions.

Beauty Salon → Add skincare products, memberships, or laser treatments.

Property Management → Include cleaning, landscaping, or handyman services.

Construction Firm → Offer equipment rental or architectural design.

The goal is simple: look at what your customers already need and trust you to deliver, then package it as part of your offering. Not only does this create steady new revenue, it also makes your business more attractive to lenders and investors by reducing reliance on a single line of income.

Final Thought

Cash flow = control, power, success. When you stay ahead of it, you’re not at the mercy of customers, suppliers, or lenders. You set the pace.

Sit down with yourself and think which of these you can apply tomorrow.