- Business Unfair Advantage

- Posts

- Into The Lender's Mind #13 The 4 KPIs That Keep Lenders Confident

Into The Lender's Mind #13 The 4 KPIs That Keep Lenders Confident

A business is a pure strategy game. Keep your eyes on the numbers.

In one of the previous newsletters, we talked about how to never run out of cash flow. Today, let’s go one step further, into the numbers that lenders (and investors) really care about.

Most business owners track sales and profit. But when you sit on the other side of the table, those aren’t the numbers that build confidence. Lenders want to see signs of stability, predictability, and resilience.

Here are the 4 KPIs that should be on your radar every single week.

1. EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortisation)

Think of EBITDA as a business’s “true operating performance.” It strips out non-cash and one-off items, showing how profitable your core business really is.

Why lenders care: It’s a clean measure of how much cash your business can generate to service debt.

Practical tip: Track it monthly, not just at year-end. Even small dips can be a red flag if unexplained.

2. Liquidity Ratio (Current Assets ÷ Current Liabilities)

Liquidity is your ability to meet short-term obligations.

Why lenders care: A liquidity ratio above 1.2 usually signals strength; below 1 can ring alarm bells.

Practical tip: Keep a rolling 3–6 month view. If cash is tight, secure credit lines before you need them.

3. Gross & Net Profit Margins

Profit is vanity if it doesn’t convert to cash, but lenders still want to see healthy margins.

Why lenders care: Strong margins mean you can absorb shocks, like rising supplier costs or late payments without tipping into the red.

Practical tip: Benchmark your margins against your industry. If you’re below average, lenders will ask why.

4. Debt Service Coverage Ratio (DSCR)

This is the big one for lending decisions. DSCR = Net Operating Income ÷ Debt Obligations.

Why lenders care: A DSCR of 1.25+ tells lenders you generate enough cash to comfortably cover repayments.

Practical tip: Run “what-if” scenarios. What happens if sales drop 10%? Can you still cover debt?

My Takeaway

Tracking these 4 KPIs doesn’t just prepare you for a loan application, it gives you control. You’ll spot weaknesses early, fix them before they snowball, and approach lenders with confidence.

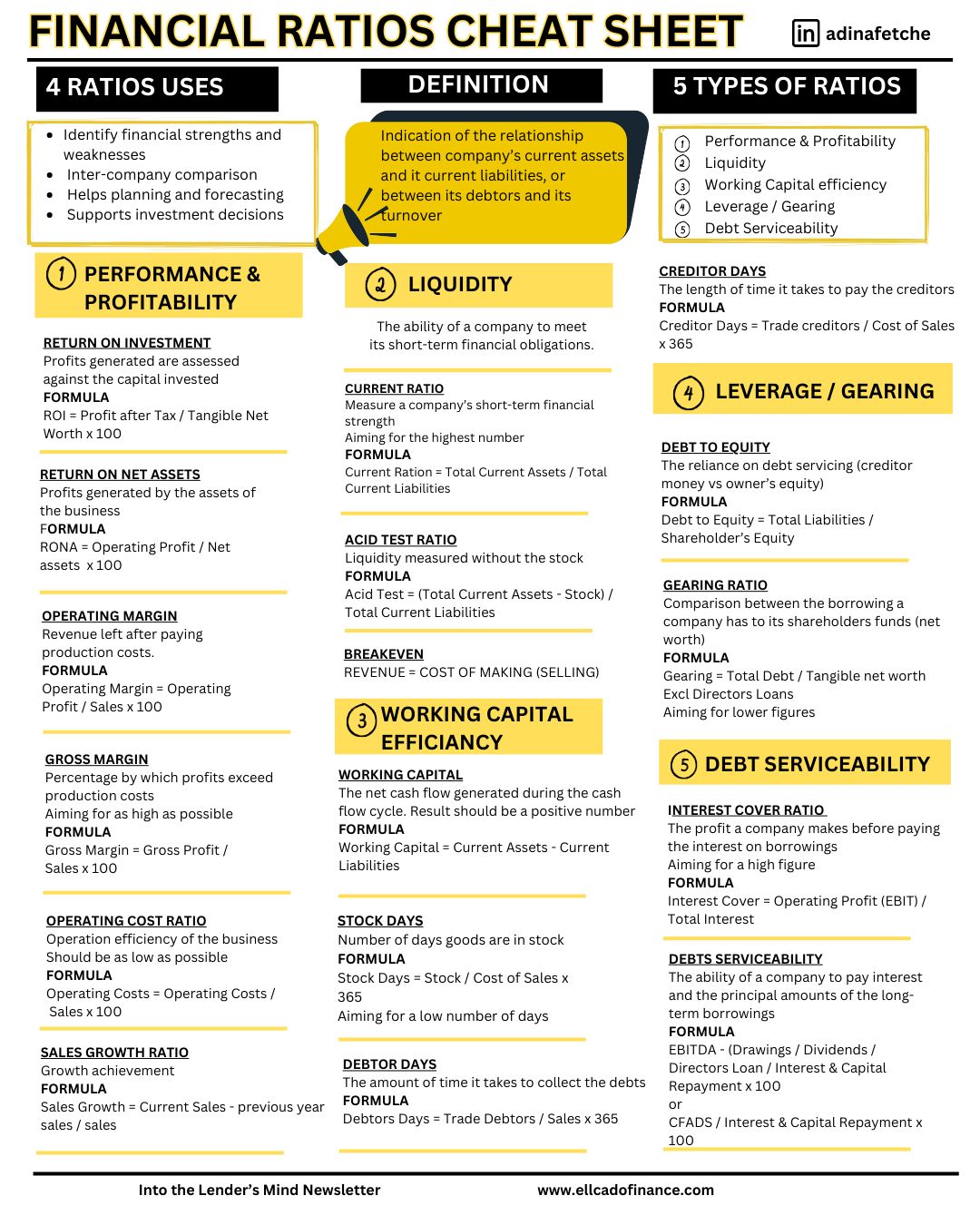

Get my viral Cheat Sheets and Infographics here

Visit my website www.ellcadofinance.com